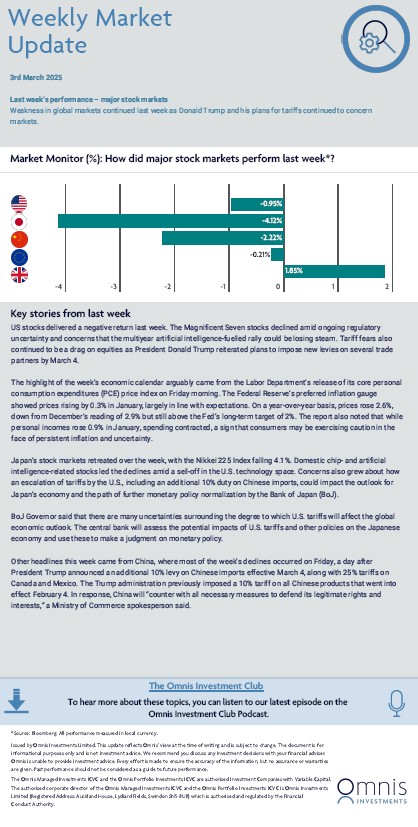

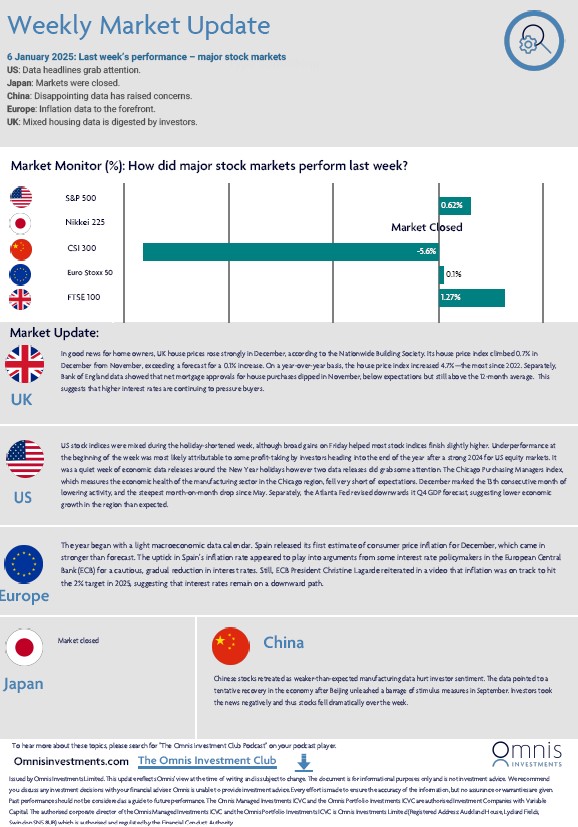

Weakness in global markets continued last week as Donald Trump and his plans for tariffs continued to concern markets.

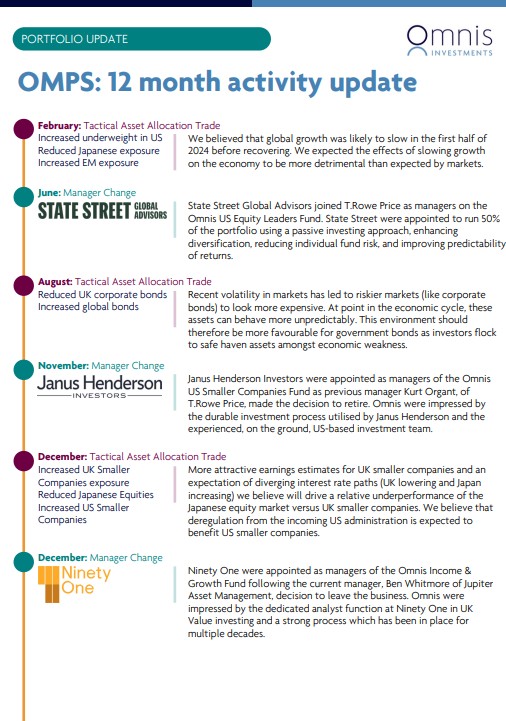

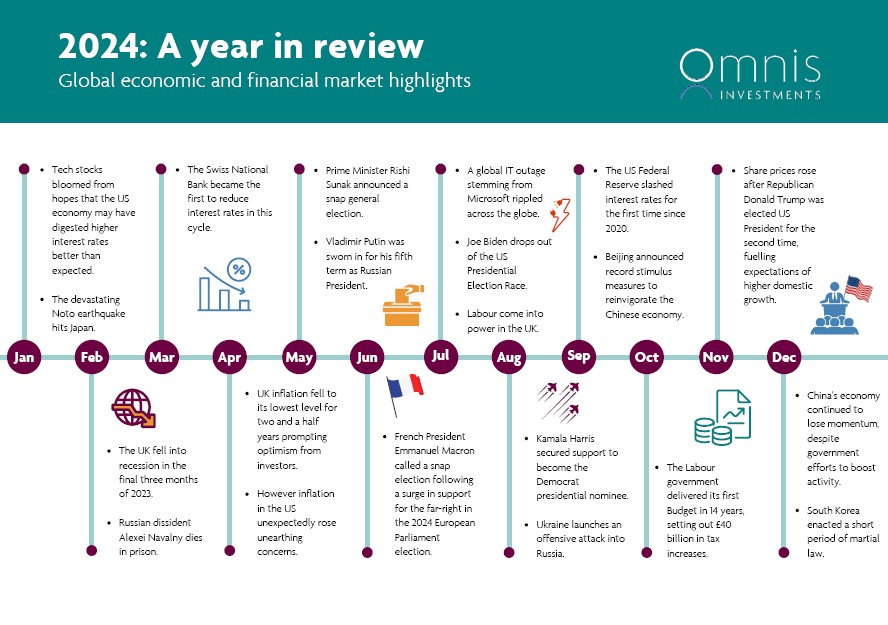

Here’s a review of how some of the key events from the past twelve months have impacted market

Apr-24: UK stocks soar to record highs amid hopes of interest rate cuts and easing geopolitical tensions. US bonds and share prices fell as inflation rises, but the economy and job market remain strong. Inflation in the Eurozone continues to fall, leading investors to expect interest rate cuts soon.

May-24: UK stocks hit record highs as the economy exits recession with 0.6% Q1 2024 growth. US inflation cooled, but job growth slowed, and unemployment rose. European stocks surged as the euro area exited recession with 0.3% GDP growth.

Jun-24: The US economy continued to expand but areas of weakness within the labour market and consumer spending started to show. The UK and US held interest rates steady whilst the EU mad their first cut.

Jul-24: Signs of stress began to emerge in the US economy as and the unemployment rate increased, and consumer spending slowed. Elsewhere, The European Central Bank reduced rates for the first time in 5 years.

Aug-24: Stock markets endured a significant bout of volatility in August amid worries about a US recession and the implications of a sharply strengthening Japanese yen. As the month progressed fears subsided, with some more supportive data and some soothing words from central banks.

Sep-24: Global stock markets rallied to new record highs after the US Federal Reserve (Fed) cut interest rates for the first time since 2020 by half a percentage point. Chinese stocks soared after Beijing rolled out further stimulus measures to arrest a slowdown in the economy.

Oct-24: Markets were dominated by the UK budget reaction and upcoming US election in October. The budget was turned unexpectedly more material for markets after the Chancellor announced a £40bn tax increase. Bond prices fell as a result of the announcement.

Nov-24: Share prices rose after Republican Donald Trump was elected US President for the second time, fuelling expectations of higher domestic growth. Chinese markets fell after a stimulus programme worth $1.4 trillion to help local governments deal with debt underwhelmed investors.

Dec-24: Equity markets struggled as we reached the end of a strong year. Investors continued to reassess their expectations for future interest rate cuts as central banks spoke about a reduced speed of interest rate reductions in 2025.

Jan-25: The FTSE 100 hit a record high as UK inflation fell to 2.5%, raising hopes for interest rate cuts. Meanwhile, as Trump raised tariffs on Mexico, China and Canada, markets grew cautious over how tariffs might impact inflation and economic growth. China continues to experience weak domestic demand.

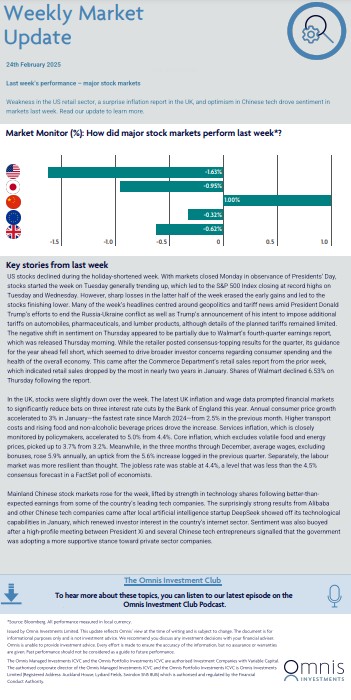

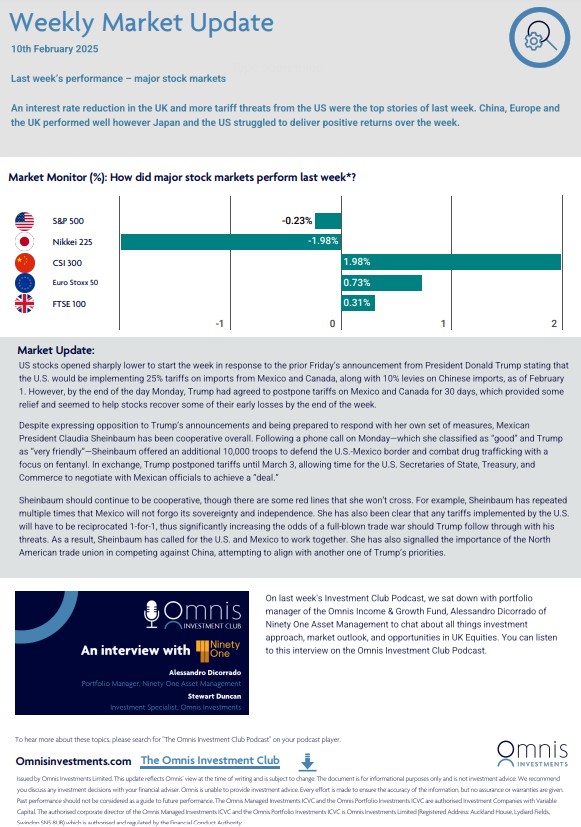

Feb-25: Global markets diverged as trade tensions hit sentiment, while strong earnings fuelled gains elsewhere. US stocks fell amid tariff uncertainty and weakening consumer demand. Trump warned of a 25% tariff on EU imports and possible UK taxes, confirmed duties on Canadian and Mexican goods, and threatened an extra 10% on Chinese imports.

Mar-25: Global stock markets came under pressure amid growing concerns about the economic impact of President Donald Trump’s tariffs. Stock market falls, trade tensions and weakening consumer sentiment, reignited US downturn fears. The EU responded to Trump’s 25% tariffs on steel and aluminium with duties on €26 billion worth of American goods.