Here’s a review of how some of the key events from the past twelve months have impacted market

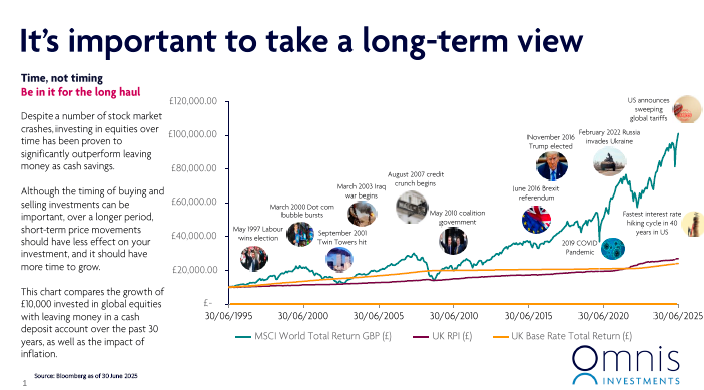

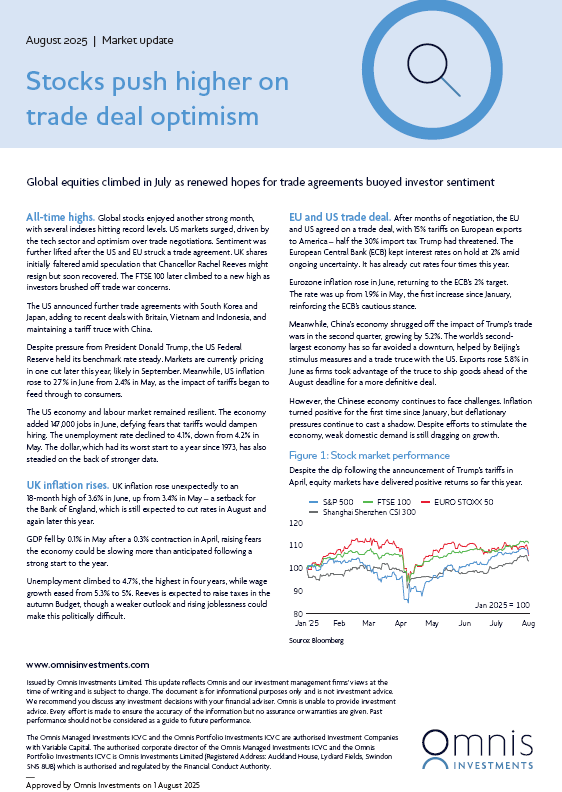

Aug-24: Stock markets endured a significant bout of volatility in August amid worries about a US recession and the implications of a sharply strengthening Japanese yen. As the month progressed fears subsided, with some more supportive data and some soothing words from central banks.

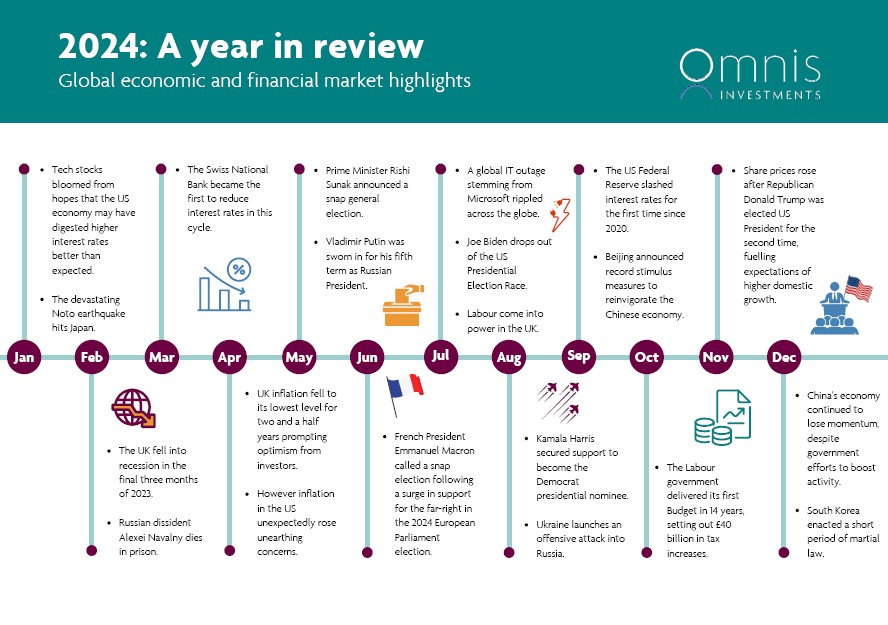

Sep-24: Global stock markets rallied to new record highs after the US Federal Reserve (Fed) cut interest rates for the first time since 2020 by half a percentage point. Chinese stocks soared after Beijing rolled out further stimulus measures to arrest a slowdown in the economy.

Oct-24: Markets were dominated by the UK budget reaction and upcoming US election in October. The budget was turned unexpectedly more material for markets after the Chancellor announced a £40bn tax increase. Bond prices fell as a result of the announcement.

Nov-24: Share prices rose after Republican Donald Trump was elected US President for the second time, fuelling expectations of higher domestic growth. Chinese markets fell after a stimulus programme worth $1.4 trillion to help local governments deal with debt underwhelmed investors.

Dec-24: Equity markets struggled as we reached the end of a strong year. Investors continued to reassess their expectations for future interest rate cuts as central banks spoke about a reduced speed of interest rate reductions in 2025.

Jan-25: The FTSE 100 hit a record high as UK inflation fell to 2.5%, raising hopes for interest rate cuts. Meanwhile, as Trump raised tariffs on Mexico, China and Canada, markets grew cautious over how tariffs might impact inflation and economic growth. China continues to experience weak domestic demand.

Feb-25: Global markets diverged as trade tensions hit sentiment, while strong earnings fuelled gains elsewhere. US stocks fell amid tariff uncertainty and weakening consumer demand. Trump warned of a 25% tariff on EU imports and possible UK taxes, confirmed duties on Canadian and Mexican goods, and threatened an extra 10% on Chinese imports.

Mar-25: Global stock markets came under pressure amid growing concerns about the economic impact of President Donald Trump’s tariffs. Stock market falls, trade tensions and weakening consumer sentiment, reignited US downturn fears. The EU responded to Trump’s 25% tariffs on steel and aluminium with duties on €26 billion worth of American goods.

Apr-25: Trade tensions intensified as President Trump announced new tariffs on Chinese imports. Whilst stock markets tumbled, they did subsequently recover after the US paused most tariff increases. As a result, the global economic outlook has weakened, and investors are expecting central banks to cut interest rates further.

May-25: Global equity markets rallied strongly after the US and China agreed to a 90-day suspension (and reduction) of tariffs. This eased concerns of an escalating trade war between the two economic superpowers. Robust corporate earnings and better-than-expected retail and manufacturing data in the US provided further tailwinds for equity markets, however, analysts warned the full economic impact may still be felt.

June-25: Geopolitical tensions rose following an escalation in the Israel-Iran conflict; however, markets were happy to look through the noise, following the announcement of a ceasefire between the two countries. Global equities extended their gains from May, rallying strongly on expectations of additional trade deals and further interest rate cuts globally.

July-25: Global equities rallied strongly on optimism surrounding trade deals between the US and many of its key trading partners. Several indices hit record highs for the month, shrugging off concerns surrounding the potential inflationary impact of tariff implementation.