UK inflation cools opening the door to further interest rate cuts

Share prices surged around the world after the US Federal Reserve slashed its benchmark interest rate

September sees steady gains as central banks cut rates, but mixed economic data keeps markets cautious

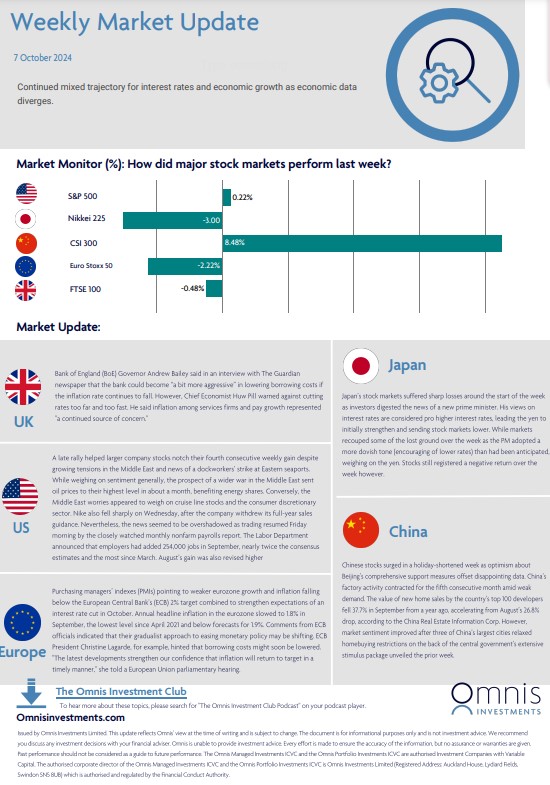

Continued mixed trajectory for interest rates and economic growth as economic data diverges.

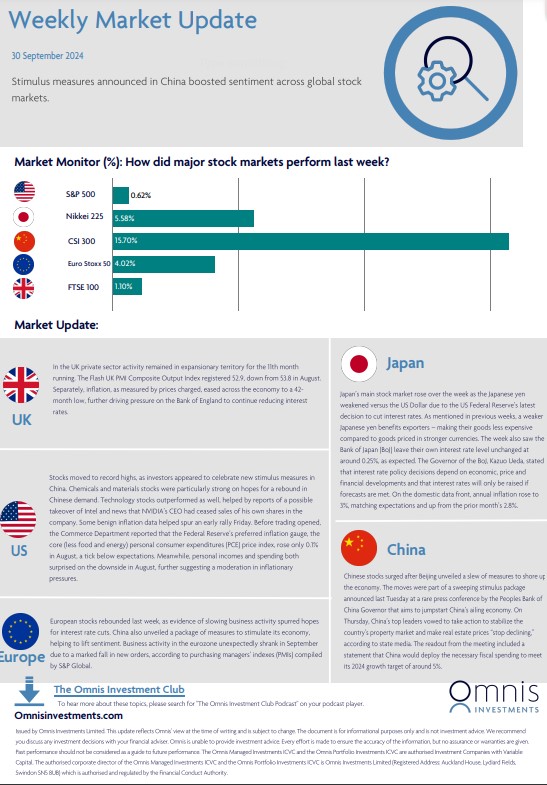

Stimulus measures announced in China boosted sentiment across global stock markets.

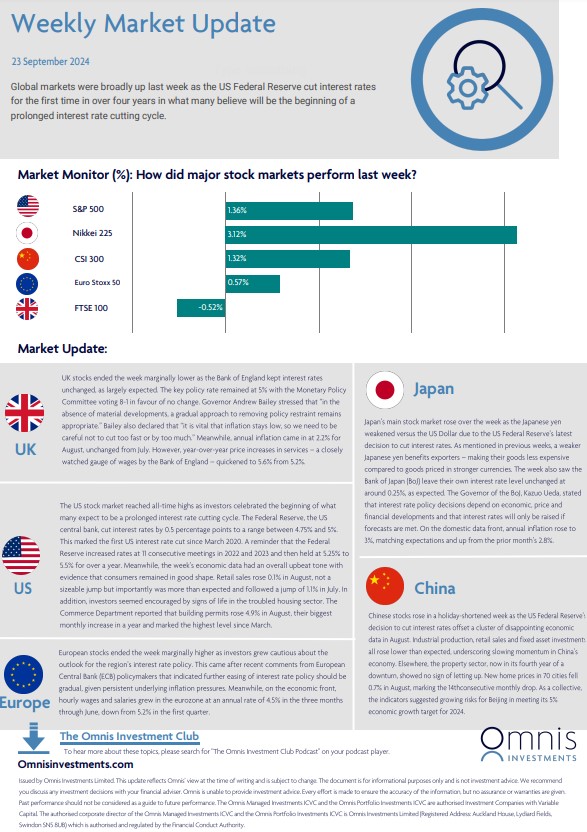

Global markets were broadly up last week as the US Federal Reserve cut interest rates

for the first time in over four years in what many believe will be the beginning of a

prolonged interest rate cutting cycle.

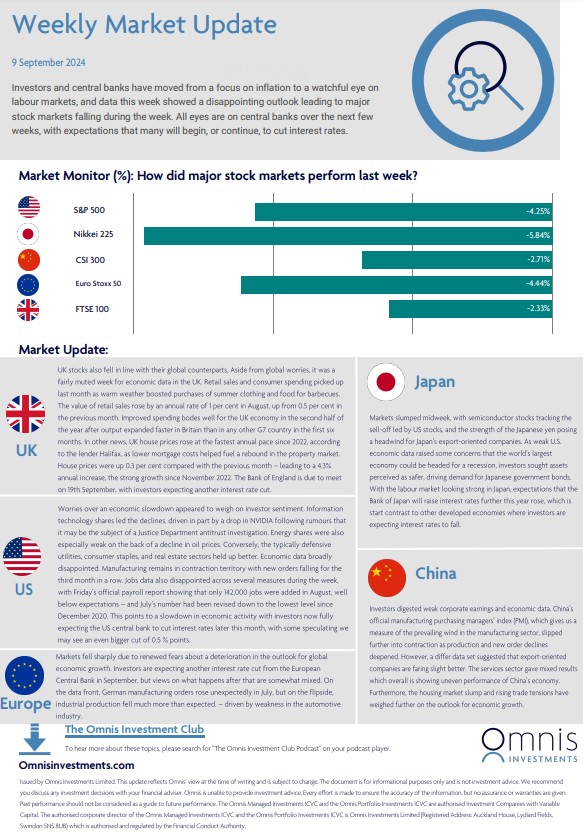

Investors and central banks have moved from a focus on inflation to a watchful eye on

labour markets, and data this week showed a disappointing outlook leading to major

stock markets falling during the week. All eyes are on central banks over the next few

weeks, with expectations that many will begin, or continue, to cut interest rates.

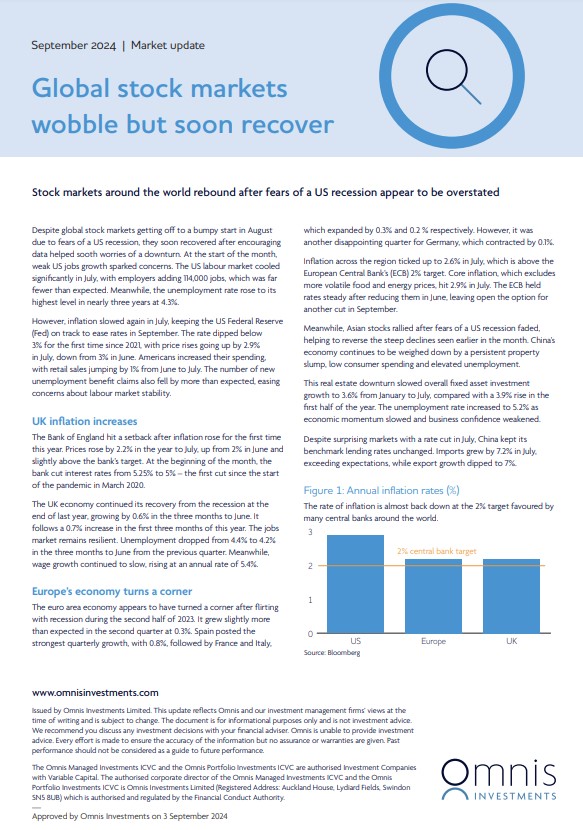

Stock markets around the world rebound after fears of a US recession appear to be overstated

August was a month of two halves with markets ending up back where they started after some volatility

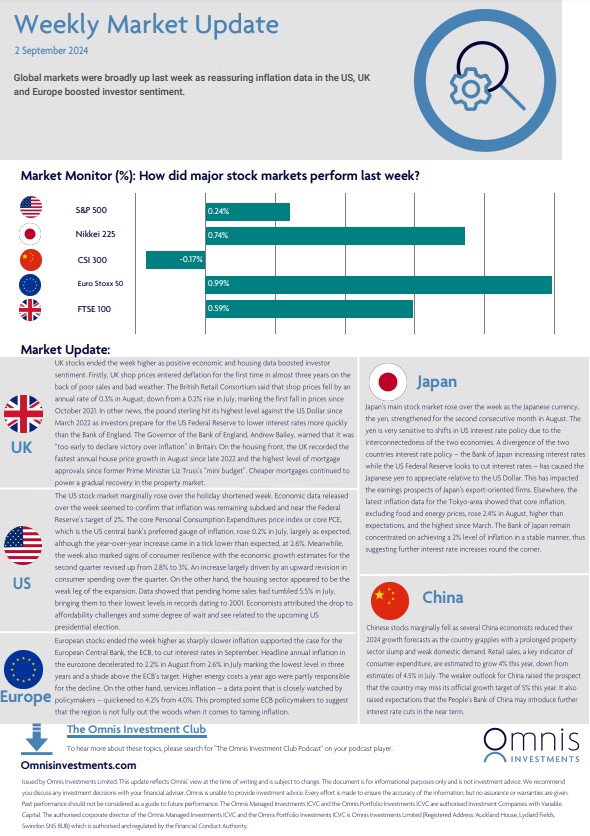

Global markets were broadly up last week as reassuring inflation data in the US, UK

and Europe boosted investor sentiment.

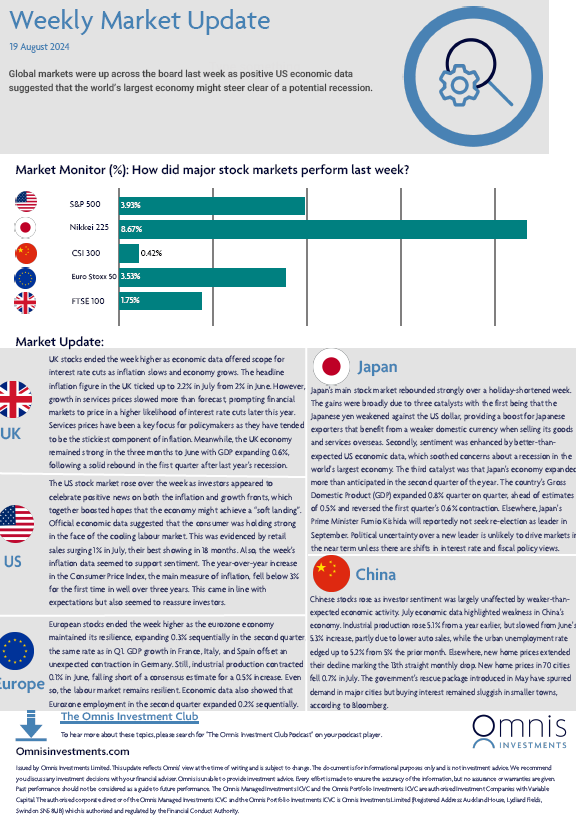

Global markets were up across the board last week as positive US economic data

suggested that the world’s largest economy might steer clear of a potential recession.

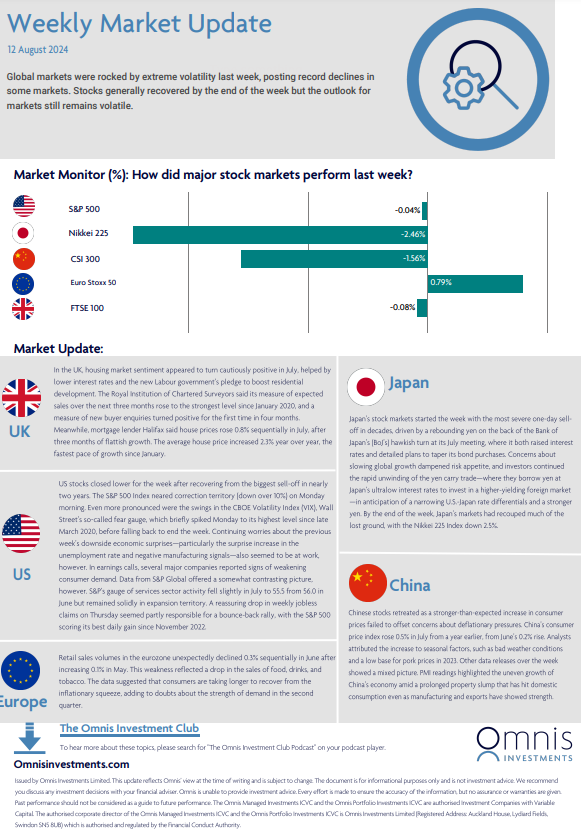

Global markets were rocked by extreme volatility last week, posting record declines in

some markets. Stocks generally recovered by the end of the week but the outlook for

markets still remains volatile.

Shares prices dip after some big tech companies miss earnings expectations

Expectations of interest rate cuts continue to influence markets against a background of political uncertainty

For the month of August, we cover:

Market-moving events

Investment highlights

Asset allocation

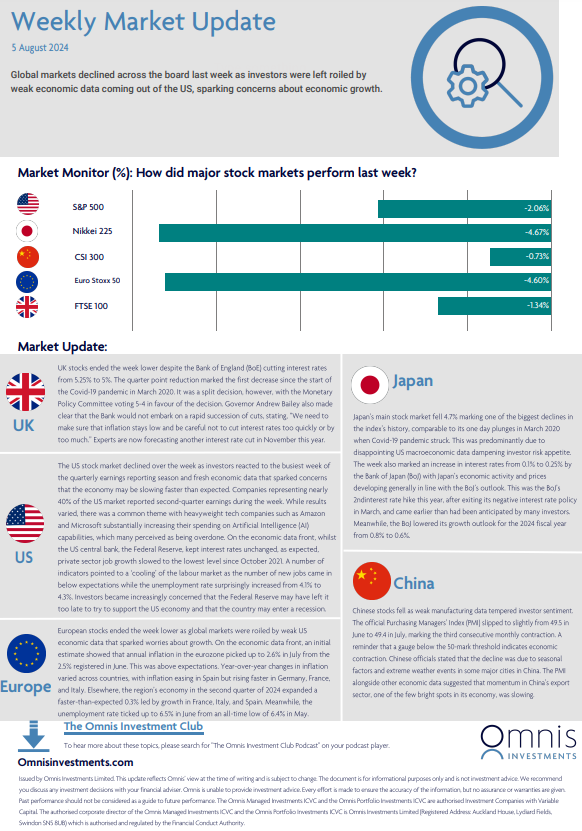

Global markets declined across the board last week as investors were left roiled by

weak economic data coming out of the US, sparking concerns about economic growth.

Here’s a review of how some of the key events from the past twelve months have impacted markets.

- Sep-23: With inflation showing signs of slowing down, the Fed and the BoE decide to not raise interest rates this month. Investors worry that despite the pause, interest rates are likely to remain higher for longer.

- Oct-23: Global markets endured a difficult month due to fears that the Fed will keep rates higher for longer. The escalating conflict in the Middle East also raised concerns that inflation may remain high after oil prices rose 6%. Hotter-than-expected inflation in the UK fuelled speculation that the BoE may keep rates higher for longer.

- Nov-23: Inflation is falling in the world’s major economies, leading economists to believe that central banks have stopped hiking interest rates and may start cutting in 2024. News of falling inflation was welcomed by investors, with markets in the US, UK and Europe all seeing positive returns in November.

- Dec-23: Markets ended the year positively in the US, UK and Europe. Investor optimism is growing, fuelled by held interest rates and expectations of cuts in 2024. China’s economic woes continue as it yet again slipped into deflation.

- Jan-24: Investors reassess their expectations for interest rates as central banks warn against early interest rate cuts. Bonds fell in value, while stock market returns varied led by Japanese equities delivering a return of over 8%. Economies and labour markets continue to show resiliency.

- Feb-24: Stock markets surged on strong corporate earnings, artificial intelligence optimism and economic data. Strong job growth kept US unemployment near a 50-year low. The UK entered a recession in the final three months of 2023. Investors continue to expect interest rate cuts to begin later in 2024.

- March-24: Global stock markets rose to record highs levels over signals from central banks suggesting future interest rate cuts. June looks well poised to potentially mark the start of a global interest rate cutting cycle.

- Apr-24: UK stocks soar to record highs amid hopes of interest rate cuts and easing geopolitical tensions. US bonds and share prices fell as inflation rises, but the economy and job market remain strong. Inflation in the Eurozone continues to fall, leading investors to expect interest rate cuts soon.

- May-24: UK stocks hit record highs as the economy exits recession with 0.6% Q1 2024 growth. US inflation cooled, but job growth slowed, and unemployment rose. European stocks surged as the euro area exited recession with 0.3% GDP growth.

- Jun-24: The US economy continued to expand but areas of weakness within the labour market and consumer spending started to show. The UK and US held interest rates steady whilst the EU mad their first cut.

- Jul-24: Signs of stress began to emerge in the US economy as and the unemployment rate increased, and consumer spending slowed. Elsewhere, The European Central Bank reduced rates for the first time in 5 years.

-

Aug-24: Stock markets endured a significant bout of volatility in August amid worries about a US recession and the implications of a sharply strengthening Japanese yen. As the month progressed fears subsided, with some more supportive data and some soothing words from central banks.